Android TV Market Growth Opportunities and Forecast till 2032

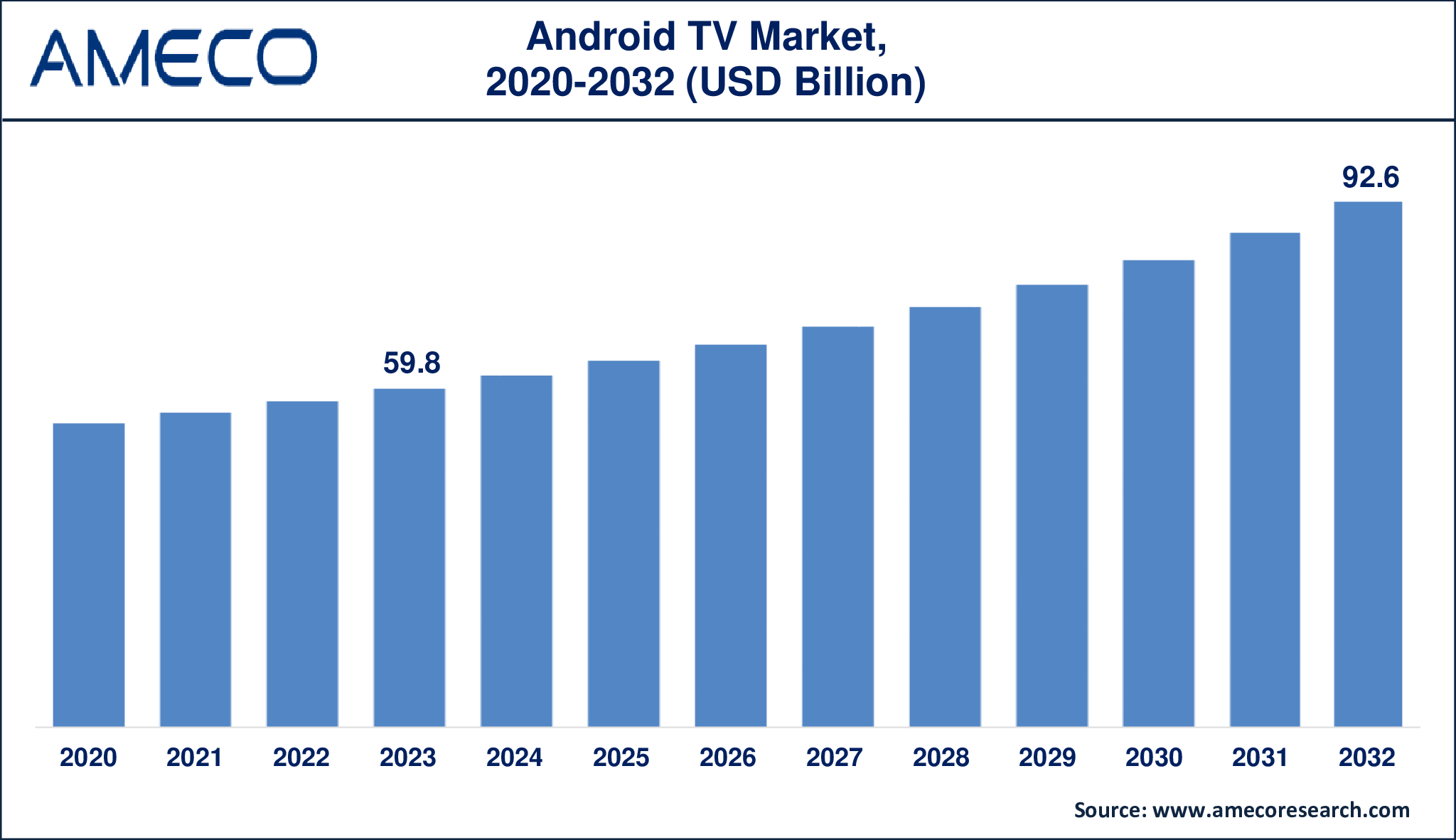

The Global Android TV Market Size was valued at USD 59.8 Billion in 2023 and is anticipated to reach USD 92.6 Billion by 2032 with a CAGR of 5.1% from 2024 to 2032.

Android TV is a smart TV operating system created by Google and it is a smart platform that merges streaming services, apps and live television all in one place. It runs on the Android platform and allows the user to install applications from the Google Play Store such as Netflix, YouTube, and Amazon Prime Video among others. The interface is designed to be best on larger displays, with controls intended for use with a remote control, voice commands via Google Assistant or other connected devices such as smartphones.

Another great aspect of android TV is that it is deeply tied into Google’s ecosystem, for instance, Chromecast, allowing users to cast content from their smartphones to the television. It also supports games and various media application hence being useful when it comes to entertainment. Android TV is employed by various TV manufacturers and streaming gadgets such as NVIDIA Shield and Google Chromecast with Google TV, and it provides a flexible interface for customers and manufacturers.

|

Parameter |

Android TV Market |

|

Android TV Market Size in 2023 |

US$ 59.8 Billion |

|

Android TV Market Forecast By 2032 |

US$ 92.6 Billion |

|

Android TV Market CAGR During 2024 – 2032 |

5.1% |

|

Android TV Market Analysis Period |

2020 - 2032 |

|

Android TV Market Base Year |

2023 |

|

Android TV Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Screen Size, By Display Type, By Resolution Type, By Sales Channel, By End-User, and By Region |

|

Android TV Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Sony Corporation, LG Electronics Inc., Panasonic Corporation, Hisense, TCL Corporation, Sharp Corporation, XiaoMi Corporation, Tosibha Corporation, Haier Inc., Skyworth Digital Holding Ltd., and One Plus. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Android TV Market Dynamics

Currently, the android TV market is rapidly growing due to the growing interest of consumers in smart home multimedia systems and the transition to streaming media. Given the growing demand for the unified platform and the personalized content consumption, android TV is a versatile and consumer-friendly platform that embraces numerous applications and services. The increasing levels of high-speed internet and the increasing interest that 4K and HDR content generate for users also contribute to the growth of Android TV adoption since users want higher quality images on their home screens. Additional features like Google services like Google Assistant, Chromecast, etc., make this platform more attractive and thus widely used.

The android TV market competition is determined by the collaboration between TV manufacturers and Google which enables such prominent brands as Sony, TCL, Hisense, etc., to launch android TV products. Such partnerships have helped in increasing the market and Android TV is now featured in most smart TVs whether in the low, mid or high end market segment. Furthermore, Android TV has an open-source platform, and this makes it flexible to be customized to fit the manufacturers’ needs and thus, the users’ experiences. Other streaming device makers including NVIDIA and Xiaomi have also embraced android TV meaning that the OS is not just limited to TV sets.

As for technology factors, the further development of artificial intelligence and voice control technology such as Google Assistant is the technological factors that fuels the market. The platform’s constant updates and the ability to integrate with other future technologies such as 8K and better gaming chops also bolster its argument. Nevertheless, future problems like competition from other smart TV platforms such as Roku or Amazon Fire TV or issues related to data privacy and protection can limit its further development. However, it is essential to understand the android TV market is still growing and has a great potential for further development due to new technologies and the growing interest of consumers in connected solutions in the field of home entertainment.

Global Android TV Market Segment Analysis

Android TV Market By Screen Size

· 31-35 Inch

· 36-45 Inch

· 46-55 Inch

· More than 60 Inch

As per the android TV industry analysis, the market was dominated by the 46-55 Inch screen size segment. This size range is affordable and provides clients with a better feel of the picture, which makes it the most preferred size range for the consumers. It has a bigger screen appropriate for today’s houses and has a relatively affordable price that attracts many users who want better picture quality particularly when streaming at 4K. Also, it is used in almost all brands and models of vehicles and is readily available, which has made it to dominate this segment. The need for high definition content as well as home theater systems has cemented this screen size in the android TV market.

Android TV Market By Display Type

· LED (Light Emitting Diodes)

· OLED (Organic Light Emitting Diode)

· QLED (Quantum Dot LED)

Based on the market trends of android TV, it has been observed that organic light emitting diode (OLED) display type segment is set to receive considerable boost in the forecast period of 2024 to 2032 in Android TV market. OLED is better in picture quality, blacks, contrast ratio, and viewing angles than LED and QLED and hence is preferred by more premium users. Due to the fact that OLED panels are becoming cheaper and more companies start using this technology, its market penetration is expected to increase. Also, the desire for enhanced viewing experience especially for 4K and 8K content will also continue to fuel the OLED displays adoption in high-end android TVs and consequently fuel this segment growth during the forecast period.

Android TV Market By Resolution Type

· 4K UHD TV

· HDTV

· Full HD TV

· 8K TV

The 4K UHD TV segment held the largest market share of Android TVs in 2023. The growth in the demand for better picture quality has been fueled by the availability of 4K content on streaming services, thus enhancing the market for 4K UHD TVs. Larger screens and better visuals are being demanded by the consumers and this has made 4K resolution the best choice for home theatre systems. Moreover, the growth in the display technology and relative decline in the prices for the 4K TVs also contributed a lot in the interest shown by the public. This segment is further strengthened by the fact that TV manufacturer has started offering 4K resolution as a standard feature in mid to premium Android TV models.

Android TV Market By Sales Channel

· Online

· Offline

The offline sales channel segment occupied a significant market share in the Android TV market. Hence, while there has been an increased trend in the purchase of TVs via e-commerce sites, many consumers still opt for the physical stores to purchase the TVs to feel the product and also to get the necessary assistance from the salespersons. Electronics chains and specialized stores remain major players in this segment because they offer demonstrations and after-sales support as well. Also, the offline channels are known to provide promotional offers to the buyers, which make them suitable. But the ongoing growth of e-commerce and the opportunity to buy groceries online are gradually changing the situation, and the online segment is gradually gaining more importance, especially among the target consumers, IT-savvy and price-sensitive.

Android TV Market By End-User

· Residential

· Commercial

· Industrial

Residential end-users produced the most income in the android TV market. This dominance is fueled largely by expanding demand for smart home entertainment solutions, as customers want high-quality, integrated watching experiences. With the rising popularity of streaming platforms, gaming, and on-demand entertainment, homes are upgrading to Android TVs with advanced display characteristics like 4K and OLED, as well as smooth access to internet services. Furthermore, the growing middle class, particularly in emerging nations, and the lower cost of smart TVs have helped to the residential segment's robust sales growth in recent years.

Android TV Market Regional Analysis

Currently, the Asia-Pacific region is the largest consumer of android TV since many consumers in countries such as China, India, and South Korea prefer smart TVs. As the population of middle-income earners increases and people become more affluent, the inhabitants of this region are inclined to use smart home entertainment systems. Such key players as TCL, Sony, and Xiaomi continue to enter the market and invest in Android TV, which also contributes to the market’s growth. Again, due to its manufacturing prowess, China is a key driver of the growth of the regional market. Furthermore, growth in the sale of 4K and 8K android TVs is fueling the growth of the market as they are now within the reach of most people in both the urban and the rural areas.

In North America and Europe, the android TV market is also expanding progressively, owing to greater smart home devices penetration and unrelenting customer interest in combined streaming service. In these regions, consumers are looking for better display quality and 4K and OLED TVs are preferred by the consumers. The use of Google services including Google Assistant and Chromecast are an added advantage for those who prefer products with integrated systems. In addition, the development of on-demand content and streaming services as well as the enhancement of internet connectivity contributes to the further growth of the Android TV market in these developed nations.

Android TV Market Leading Companies

The android TV market players profiled in the report is Sony Corporation, LG Electronics Inc., Panasonic Corporation, Hisense, TCL Corporation, Sharp Corporation, XiaoMi Corporation, Tosibha Corporation, Haier Inc., Skyworth Digital Holding Ltd., and One Plus.

Android TV Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa