Electric Vehicle Charging Station Market Growth Opportunities and Forecast till 2033

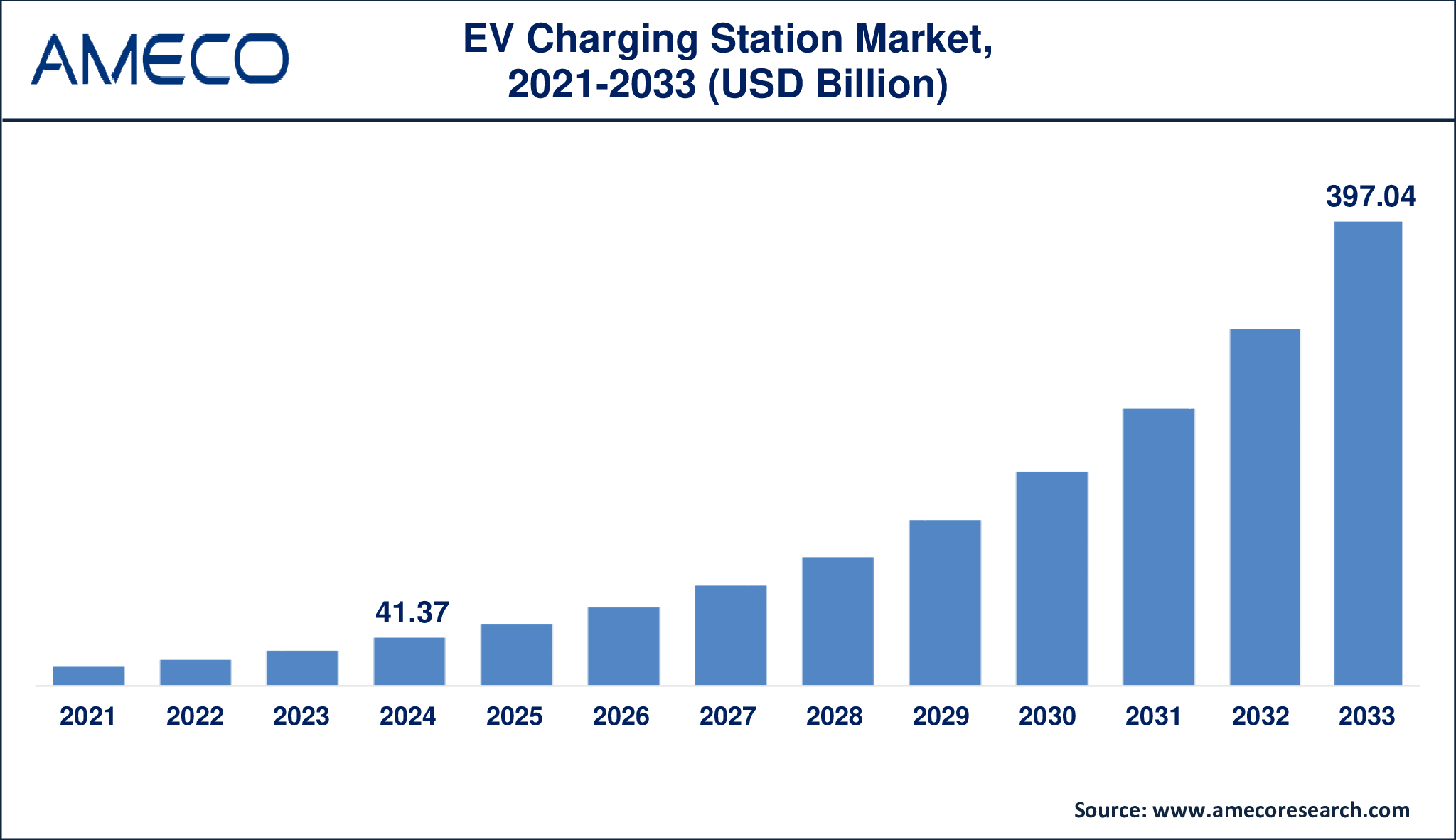

The Global Electric Vehicle Charging Station Market Size was valued at USD 41.37 Billion in 2024 and is anticipated to reach USD 397.04 Billion by 2033 with a CAGR of 28.7% from 2025 to 2033.

EV charging stations serve as core infrastructure elements for the expanding electric mobility system. The power supply for BEVs and PHEVs occurs through EV chargers that function similarly to chargers for other rechargeable electronic devices. The accelerated worldwide adoption of EVs demands critical development and expansion of EV charging infrastructure. EV charging stations function as operational supports for regular vehicle use and provide a means for long-distance travel independent of fossil fuels which leads to cleaner sustainable transportation options.

EV charging infrastructure features a charger spectrum ranging from residential slow units to quick and ultra-quick public models which enables charging across residential, workplace and public areas including service stations and highways and malls. The IEA predicts that public charging points will reach over 15 million worldwide by 2030 in their STEPS and APS scenarios while the current count stands at nearly 4 million in 2023. The APS projection indicates that public charging stations will reach approximately 25 million by 2035 while increasing six times from 2023 levels. The quick rise in EV adoption requires immediate investments in smart charging systems and upgraded grid infrastructure alongside policy backing to deliver continuous EV charging capabilities worldwide.

|

Parameter |

Electric Vehicle Charging Station Market |

|

Electric Vehicle Charging Station Market Size in 2024 |

US$ 41.37 Billion |

|

Electric Vehicle Charging Station Market Forecast By 2033 |

US$ 397.04 Billion |

|

Electric Vehicle Charging Station Market CAGR During 2025 – 2033 |

28.7% |

|

Electric Vehicle Charging Station Market Analysis Period |

2021 - 2033 |

|

Electric Vehicle Charging Station Market Base Year |

2024 |

|

Electric Vehicle Charging Station Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Level, By Installation Type, By Connector, By Charging Point Type, By Vehicle Class, By End Use, and By Region |

|

Electric Vehicle Charging Station Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

ABB, Blink Charging Co., ChargePoint Inc., Eaton, EVBox, EO Charging, Schneider Electric, Siemens AG, Tesla, and Webasto Group. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Electric Vehicle Charging Station Market Dynamics

The electric vehicle charging station market is expanding rapidly due to the surge in environmental awareness and worldwide initiatives to decrease greenhouse gas emissions. The world faces accelerating climate change which makes governments focus on decarbonization strategies while targeting transportation because it generates significant CO₂ emissions. EVs serve as an environmentally friendly alternative to ICE vehicles because they generate no exhaust emissions from their tailpipes. Different countries have implemented strict emission rules and future ICE vehicle bans together with incentives including tax breaks and EV purchase subsidies and rebates. The combination of EV adoption support initiatives has contributed to higher demand for charging infrastructure that is both accessible and widespread.

The EV charging station market also receives a driving force from public-private sector collaboration that aims to expand EV charging networks. For instance, the U.S. Department of Energy documented a 55% surge in public EV charging stations throughout 2023 because of the fast-growing infrastructure deployment pace.

However, strong growth prospects stand in the way of EV charging station expansion because of existing challenges. These stations become financially unprofitable for low-traffic areas because they require substantial initial installation expenses and dedicated space as well as maintenance personnel. Some governments restrict the revenue potential of station operators through per-unit electricity cost price caps which discourages investment. In addition, infrastructure limitations, especially in rural or underdeveloped regions, also slow progress. Upgrading electrical grids in numerous locations becomes necessary to handle the growing power demands from fast-charging stations but creates delays and higher expenses in deployment.

Furthermore, the developing EV industry offers multiple possibilities for new innovations and investment opportunities. New technology advancements including wireless charging systems as well as automated charging robots and vehicle-to-grid (V2G) systems will enhance user experience and improve grid connectivity. For instance, Siemens AG has launched the Sicharge D high-capacity charger which provides 300 kW of power to meet the needs of upcoming EVs with bigger battery systems.

National authorities continue to invest substantial funds in order to fast-track their network development programs. The United Kingdom's Office for Zero Emission Vehicles dedicates almost USD 989 million to fund rapid charging infrastructure development. The California Energy Commission (CEC) provides funding of USD 1.4 billion to support joint ventures which will establish 16,000 EV charging points and hydrogen refueling stations across the state before 2024. Public-sector support plays a vital role in expanding infrastructure according to these initiatives.

One significant EV charging station market trend is the demonstration of a decisive movement from conventional AC slow chargers toward high-speed DC fast chargers because users need faster charging capabilities. Urban areas and highway corridors together with commercial zones are experiencing an increasing adoption of integrated Level 2 and DC fast charging stations. The number of public charging stations (Ather Grid) operated by Ather Energy is expanding through their installations in both metropolitan and tier-II and tier-III cities across India as companies focus on equitable access. Ather Energy maintained 580 charging stations across India during late 2022 and targeted 1,400 stations by the end of their FY23 financial period.

EV charging systems are increasingly combining with renewable energy technologies is another major EV charging infrastructure market trend. The combination of solar energy with charging stations and battery storage systems shows growing popularity because it provides sustainable and economical charging solutions. The integration of renewable energy solutions in EV charging infrastructure supports national energy transition targets while improving the overall charging system reliability.

Global Electric Vehicle Charging Station Market Segment Analysis

EV Charging Station Market By Level

· Level 3

· Level 2

· Level 1

Electric vehicle charging stations using Level 2 technology leads the market because they strike a good price-performance-speed-versatility ratio. These devices deliver a range of 10 to 60 miles per hour of charging time which suits homes as well as public spaces. Such charging stations are popular because they install easily and support most EV models while working in homes and workplaces and commercial sites.

EV Charging Station Market By Installation Type

· Fixed

· Portable

The public prefers fixed charging stations because they deliver durable and dependable performance. These chargers function as permanent installations because they suit locations that experience regular use throughout homes and businesses as well as public spaces. Portable chargers serve as emergency backup devices that provide temporary power but they are not designed for regular day-to-day charging operations.

EV Charging Station Market By Connector

· J1772

· Mennekes

· GB/T

· CCS1

· CHAdeMO

· CCS2

· Tesla

The GB/T connector demonstrates substantial market potential because China uses this standard across the country as its national requirement. This connector enables charging through both AC and DC power and works with numerous Chinese EV models. The GB/T standard from China is growing in popularity among emerging markets that adopt Chinese-made vehicles and technology and expand their electric vehicle export activities.

EV Charging Station Market By Charging Point Type

· Wireless Charging

· AC Charging

· DC Charging

The high demand for EV fast charging occurs at locations where DC fast chargers operate because they provide rapid energy replenishment for electric vehicles within sixty minutes or less. Public stations along with cities and highways require these essential charging facilities for fast driver operations. DC chargers have emerged as essential components of the public charging infrastructure because of growing long-range electric vehicles coupled with government policy support.

EV Charging Station Market By Charging Service

· EV Charging Service

· Battery Swapping Service

The EV charging station market forecast shows that EV charging services have gained popularity because charging stations expand in residential areas and commercial sites and public spaces. The stations enable users to charge their vehicles using DC or AC power thus making them available to a wide range of potential customers. Under their March 2024 collaboration ChargePoint provided GATE with integrated electric vehicle fleet charging solutions. The collaboration enables ChargePoint to deliver complete electric mobility solutions including equipment supply and installation and technical support and software management to simplify the business transition to electric vehicles. The implementation of battery swapping services faces constraints because of EV platform requirements for standardized designs.

EV Charging Station Market By End Use

· Commercial Vehicle

· Passenger Cars

The EV charging station market will experience significant growth due to increasing electric vehicle purchases by passengers who want to protect the environment. Total vehicle production in April 2024 exceeded 2.35 million units per month with passenger vehicles representing a large portion of this figure as per the India Brand Equity Foundation data. The increasing number of electric car drivers for city and daily travel creates a rising need for dependable charging infrastructure. The growth of electric vehicle passenger cars in the market drives governments and private companies to invest in developing charging networks that will support the increasing demand.

Electric Vehicle Charging Station Market Regional Analysis

The Asia-Pacific region demonstrates strong growth in electric vehicle adoption as the governments provide backing along with environmental programs and increasing urban populations. The countries of China and Japan and South Korea lead the EV market by implementing aggressive EV policies while providing incentives which in turn drive the need for efficient urban charging infrastructure. China demonstrates its position as a worldwide leader when it comes to EV charging technology. Major manufacturers operate in this territory to produce high-tech fast chargers combined with wireless systems and intelligent charging solutions. Modern innovations enhance both the operational efficiency and cost-effectiveness and nationwide accessibility of EV charging stations.

The North American EV charging station market continues its rapid expansion because of economic growth and employment increases and quick technology adoption rates. The rising EV adoption in the U.S., Canada and Mexico has led to increasing requirements for additional charging stations. The governments of Canada and the U.S. established a May 2023 agreement to create an EV charging path connecting Quebec to Michigan. The charging station installation plan provides stations at every 80 kilometer interval and each site must contain a minimum of one DC fast charger. The 215 Canadian charging stations will establish essential connections between Detroit and Quebec City.

Electric Vehicle Charging Station Market Leading Companies

The Electric Vehicle Charging Station market players profiled in the report is ABB, Blink Charging Co., ChargePoint Inc., Eaton, EVBox, EO Charging, Schneider Electric, Siemens AG, Tesla, and Webasto Group.

Electric Vehicle Charging Station Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East and Africa