Hydrogen Energy Storage Market Growth Opportunities and Forecast till 2032

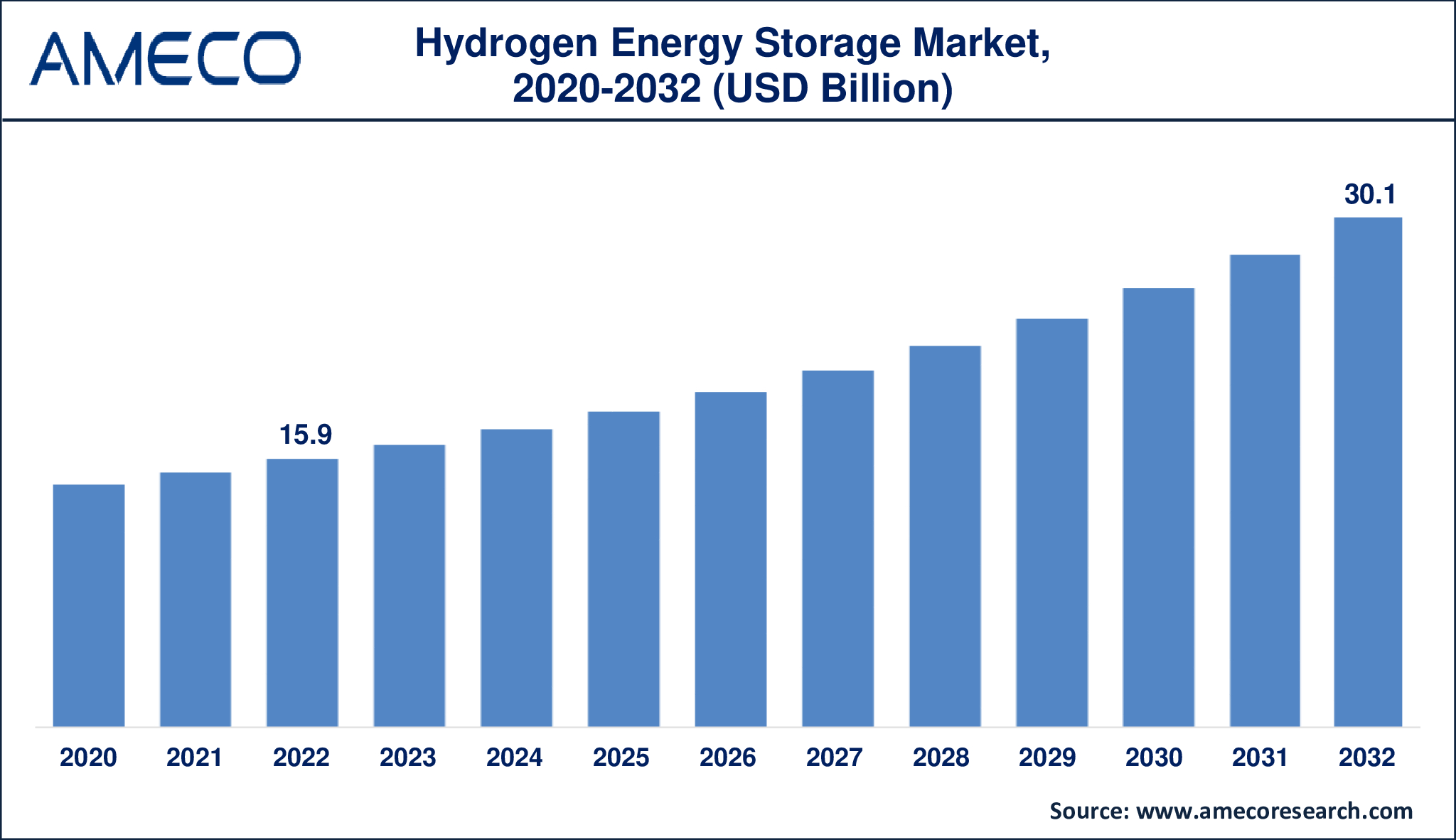

The Global Hydrogen Energy Storage Market Size was valued at USD 15.9 Billion in 2022 and is anticipated to reach USD 30.1 Billion by 2032 with a CAGR of 6.8% from 2023 to 2032.

Hydrogen is the most versatile type of energy storage since it may be produced and stored on any scale and utilized as a fuel, chemical material, or natural gas substitute. Hydrogen storage is an important facilitator of hydrogen and fuel cell technology advancement in applications such as fixed power, portable power, and transportation. Hydrogen fuel cells might assist provide a cleaner answer to power generation demands, such as powering everything from small electronic devices to automobiles, airplanes, and even large buildings, as part of international efforts to reduce emissions and the use of carbon-based fuels. Since hydrogen has the highest energy density per mass of all fuels, but the lowest energy density per unit volume because of its low ambient temperature, better storage techniques that have the potential to raise energy density must be developed.

|

Parameter |

Hydrogen Energy Storage Market |

|

Hydrogen Energy Storage Market Size in 2022 |

US$ 15.9 Billion |

|

Hydrogen Energy Storage Market Forecast By 2032 |

US$ 30.1 Billion |

|

Hydrogen Energy Storage Market CAGR During 2023 – 2032 |

6.8% |

|

Hydrogen Energy Storage Market Analysis Period |

2020 - 2032 |

|

Hydrogen Energy Storage Market Base Year |

2022 |

|

Hydrogen Energy Storage Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By State, By Storage Technology, By End-User, and By Region |

|

Hydrogen Energy Storage Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Air Liquide, Air Products, Inc., Cummins, Inc., Engie, ITM Power, Iwatani Corp., Linde plc, Nedstack Fuel Cell Technology BV, Nel ASA, and Steelhead Composites, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Hydrogen Energy Storage Market Dynamics

The key aspect driving the worldwide hydrogen energy storage market is the increased usage of stored hydrogen for stationary and backup power applications. Adobe, Apple, AT&T, Coca-Cola, Google, Honda, Microsoft, and Walmart are just a few of the firms that are using fuel cells for primary and backup power. According to FCHEA's tracking and surveys, more than 550 megawatts (MW) of stationary fuel cells have been installed in the United States as of January 2020, providing clean, reliable, and distributed power to clients across the country. Organizations are looking at fuel cells as an attractive option for reliable backup power, recognizing the dangers of grid dependency. The DOE and the US Department of Defense are also assessing how fuel cells work in real-world operations as part of an interagency relationship, identifying changes manufacturers could make to improve the value proposition, and showcasing the benefits of fuel cells for diverse applications.

In addition, greater use of hydrogen storage as a fossil fuel alternative by a variety of end-users is expected to boost the industry's growth. Traditional combustion technologies are two to three times less efficient than hydrogen-powered fuel cells. A standard combustion-based power plant produces energy at about 35% efficiency, whereas fuel cell systems can generate electricity at up to 60% efficiency. Thus, the demand for hydrogen energy storage is expanding at a significant rate. The market is however restricted by a few factors such as the high cost of hydrogen energy storage systems and the presence of efficient renewable energy technologies.

Furthermore, the growing dependency on hydrogen energy storage systems has made many public and private organizations invest in the technology. For instance, the number of countries with policies actively encouraging investment in hydrogen technology and the sectors they target is increasing. Currently, there are over 50 targets, criteria, and policy incentives in place to promote hydrogen, with the majority of them focusing on transportation. Furthermore, in recent years, national governments have boosted their expenditures on hydrogen energy research, development, and demonstration.

Global Hydrogen Energy Storage Market Segment Analysis

Hydrogen Energy Storage Market By State

· Solid

· Liquid

· Gas

Among states, the market is categorized into solid, liquid, and gas. Hydrogen can be stored as both a gas and a liquid. High-pressure tanks (350-700 bar or 5000-10,000 psi) are typically used for hydrogen gas storage, whereas cryogenic temperatures are required for liquid hydrogen storage to prevent it from boiling back into a gas (which occurs at 252.8°C). Hydrogen can also be stored on the surface of solid materials (adsorption) or within them (absorption).

Hydrogen Energy Storage Market By Storage Technology

· Compression

· Liquefaction

· Material-Based

Based on storage technology, the market is split into compression, liquefaction, and material-based. Currently, compression technology has dominated the storage technology segment with the highest shares. Under high pressures, hydrogen can be compressed and stored as a gas. Hydrogen can be kept in a variety of ways, including compressed as a gas or as a liquid. There are three types of hydrogen storage materials: those that store hydrogen on the surface of the material, those that store hydrogen within the material, and hydride storage, which employs a combination of solid and liquid materials.

Hydrogen Energy Storage Market By End-User

· Utility

· Industrial

· Commercial

Industrial, commercial, and utility are the categorization of the end-user segment. Among them, utilities are predicted to be the fastest-growing market as electricity demand grows, and the use of renewable energy sources is likely to lift the demand for hydrogen energy storage in the utility sector. However, industrial and commercial end-users are contributing to a significant share of the segment.

Hydrogen Energy Storage Market Regional Analysis

The global hydrogen energy storage industry is segmented across several regions, including North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa. Among these regions, Asia-Pacific emerged as a significant player in 2022, securing a substantial share of the market. This growth can be attributed to various factors, including the impact of productivity enhancements, technological advancements, and the increasing adoption of hydrogen energy storage systems in key countries such as China, Japan, and India. These nations have been actively investing in renewable energy infrastructure and transitioning towards cleaner energy sources, thereby driving the demand for hydrogen energy storage solutions.

However, the North American region is poised for rapid growth, projected to exhibit the fastest compound annual growth rate (CAGR) during the forecast period from 2023 to 2032. This growth trajectory is fueled by several factors, including favorable government regulations aimed at promoting renewable energy adoption and reducing carbon emissions. Additionally, the presence of a large number of key companies operating in the hydrogen energy storage market in North America contributes to the region's market expansion. These companies are investing in research and development initiatives, collaborating with government agencies and research institutions, and deploying innovative technologies to enhance the efficiency and scalability of hydrogen energy storage solutions. Overall, North America's hydrogen energy storage market is anticipated to witness significant growth opportunities in the coming years.

Hydrogen Energy Storage Market Leading Companies

The Hydrogen Energy Storage market players profiled in the report are Air Liquide, Air Products, Inc., Cummins, Inc., Engie, ITM Power, Iwatani Corp., Linde plc, Nedstack Fuel Cell Technology BV, Nel ASA, and Steelhead Composites, Inc.

Hydrogen Energy Storage Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa