Marine Scrubber Market Analysis 2025 - 2033: Growth Trends, Key Players, Opportunities & Global Forecast

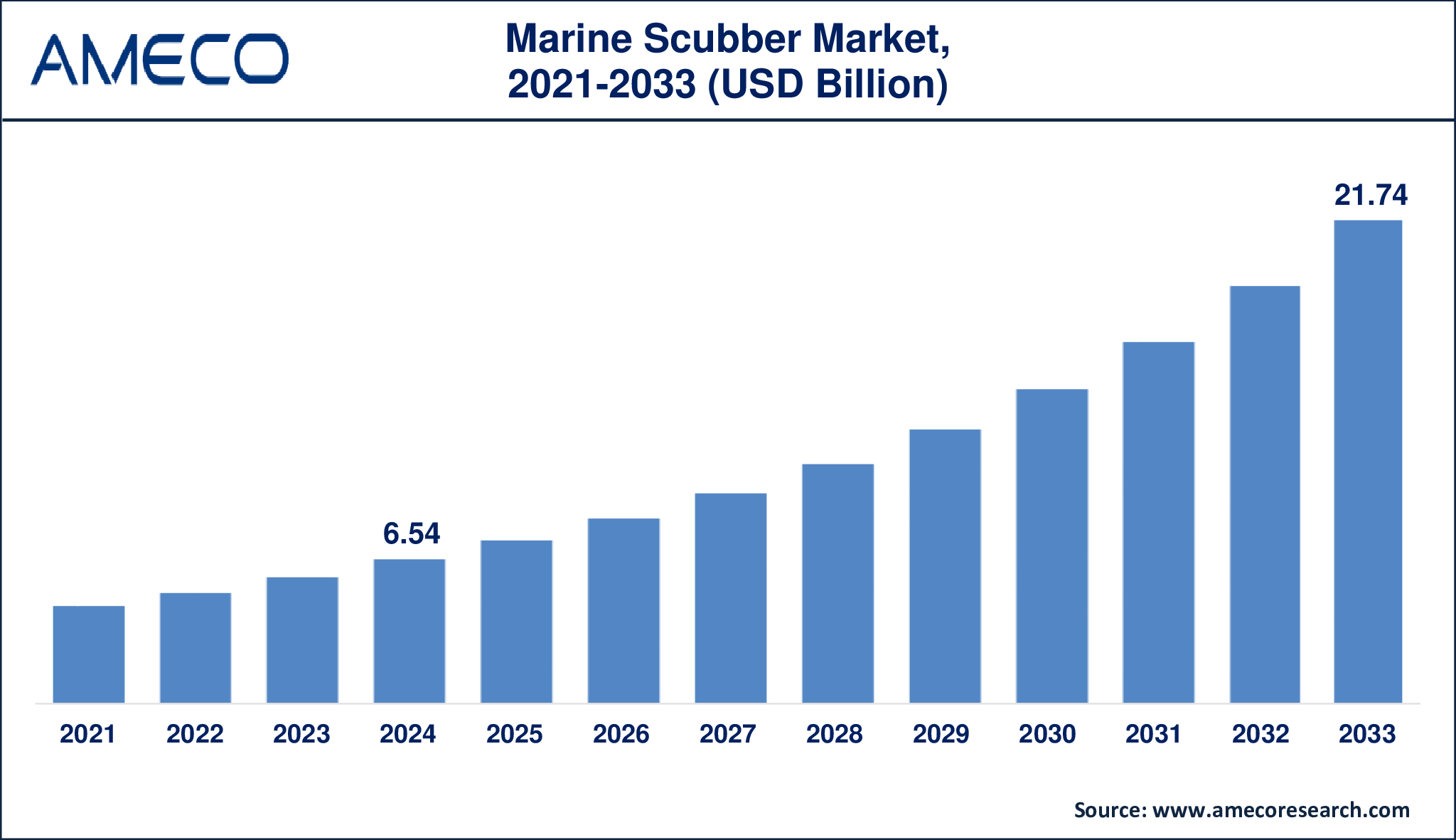

The Global Marine Scrubber Market Size was valued at USD 6.54 Billion in 2024 and is anticipated to reach USD 21.74 Billion by 2033 with a CAGR of 14.5% from 2025 to 2033.

The marine scrubber market has emerged as a critical option for the shipping industry's shift to cleaner emissions, as international environmental requirements drive the change. Marine scrubbers, also known as exhaust gas cleaning systems (EGCS), remove sulfur oxides (SOx) from ship exhausts, allowing boats to fulfill IMO 2020 sulfur content limits in marine fuels of 0.5%. This technique offers a cost-effective option to transitioning to low-sulfur fuel, allowing shipowners to continue using high-sulfur fuel oil (HSFO) while adhering to strict standards. The global push for better shipping practices, increased pressure from environmental groups, and the shipping industry's desire for cost-effective compliance techniques are all driving up demand for marine scrubbers. Their involvement is critical in the industry's shift toward more sustainable and responsible maritime operations.

|

Parameter |

Marine Scrubber Market |

|

Marine Scrubber Market Size in 2024 |

US$ 6.54 Billion |

|

Marine Scrubber Market Forecast By 2033 |

US$ 21.74 Billion |

|

Marine Scrubber Market CAGR During 2025 – 2033 |

14.5% |

|

Marine Scrubber Market Analysis Period |

2021 - 2033 |

|

Marine Scrubber Market Base Year |

2024 |

|

Marine Scrubber Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Technology, By Fuel Type, By Installation, By Application, and By Region |

|

Marine Scrubber Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Clean Marine AS, Alfa Laval AB, Damen Shipyards Group N.V., Ecospray Technologies S.r.l., DuPont, Fuji Electric Co. Ltd., Valmet Corporation, Mitsubishi Heavy Industries, Wärtsilä Oyj Abp, and Yara Marine Technologies AS. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Marine Scrubber Market Dynamics

Advancing environmental regulations continue to be the primary driver of the marine scrubber market. The International Maritime Organization (IMO) implemented the MARPOL Annex VI regulations in January 2020, mandating a global sulfur cap of 0.5% in marine fuels, a significant reduction from the earlier 3.5% limit. This regulation alone caused a rise in scrubber installations, according to the International Chamber of Shipping, with over 4,700 boats reported to have scrubbers by mid-2021. Shipowners use scrubbers to save money on Marine Gas Oil (MGO) and other low-sulfur fuels, allowing them to maintain competitive operating costs.

Furthermore, the increased use of LNG and hybrid fuel systems in the maritime industry has a mixed effect. While LNG has minimal sulfur emissions, hybrid ships nevertheless require scrubbers to maximize operating flexibility. According to DNV's "Maritime Forecast to 2050," hybrid and LNG-powered boats will account for 25% of new builds by 2030, highlighting scrubbers' continued significance for existing fleets running on conventional fuels.

One constraint on the maritime scrubber business is environmental concern over washwater output from open-loop scrubbers. To reduce ocean acidification and pollution, some major ports, notably Singapore, Fujairah, and China, have restricted or prohibited the use of open-loop scrubbers within their territorial seas. These regulatory constraints are forcing shipowners to seek closed-loop and hybrid systems, increasing the complexity and cost of adoption.

Technological progress in the sector presents numerous opportunities. Researchers are working on cleaner, zero-discharge scrubber technologies, digital monitoring systems for real-time emissions tracking, and lightweight modular scrubber modules to increase system performance and lower installation costs. Emerging collaborations between maritime technology businesses and academic institutes have the potential to propel the next generation of scrubber solutions.

Global Marine Scrubber Market Segment Analysis

Marine Scrubber Market By Technology

· Wet Technology

o Hybrid Technology

o Open Loop Technology

o Closed-Loop Technology

· Dry Technology

Wet technology remains the market's largest segment. It dominates due to its low cost and demonstrated operating efficiency in decreasing SOx emissions across a wide range of vessel types. According to the International Maritime Organization's Global Sulphur Strategy study, wet technology systems, notably open-loop and hybrid designs, will account for roughly 80% of installed scrubbers by 2022. Wet scrubbers employ water (seawater or freshwater mixed with alkali) to neutralize sulfur oxides, providing dependable performance for ships operating largely in international waters. Their versatility across vessel sizes, as well as the availability of hybrid models capable of switching modes based on environmental requirements, make them more appealing to shipowners around the world.

Marine Scrubber Market By Fuel Type

· MDO

· LNG

· MGO

· Hybrid

According to marine scrubber industry analysis, hybrid fuels are gaining significant market share. Hybrid boats, which may run on a mix of fuels such as LNG and low-sulfur diesel, require adaptable pollution control systems. Hybridization enables shipping businesses to optimize fuel consumption based on route and port regulations. According to a DNV estimate from 2023, hybrid propulsion systems would contribute for 20%-30% of commercial fleet upgrades by 2035, increasing need for flexible scrubbers that can operate on diverse fuels. Hybrid systems align with sustainability aims while also ensuring future-proof compliance with more stringent environmental rules, making this category crucial for future market growth.

Marine Scrubber Market By Installation

· Retrofit

· New Build

The retrofit segment generates the maximum revenue in the marine scrubber market. Retrofitting existing vessels is more economical than purchasing new ships fitted with compliance systems, especially for operators of large fleets. According to Clarksons Research, about 72% of scrubber installations by 2022 were retrofits rather than part of new builds. Retrofit projects enable owners to extend the operational life of aging boats while meeting regulatory standards without incurring prohibitively high replacement costs. Furthermore, retrofit solutions are becoming more modular and standardized, reducing downtime and installation complexity. As fuel costs fluctuate and environmental rules tighten, retrofitting is a preferred method for ship owners seeking to balance operating efficiency and compliance.

Marine Scrubber Market By Application

· Commercial

o Containers

o Bulk Carriers

o Roll On/Roll Off

o Tankers

· Recreational

o Yachts

o Cruise Ships

o Ferries

· Offshore

o PSV

o AHTS

o MPSV

o FSV

· Navy

Commercial bulk ships are the largest application sector in the marine scrubber market. Bulk carriers, which transport commodities such as coal, grain, and iron ore, operate on lengthy international routes and often utilize high-sulfur fuel oil since it is less expensive. Scrubber installation allows these vessels to continue operating economically while adhering to emissions control rules. The Baltic and International Maritime Council (BIMCO) estimates that by 2022, bulk carriers will account for around 35% of all scrubber-equipped vessels. Their enormous engine outputs and high emission profiles make them great candidates for scrubber technology, and continuous global trade demand supports long-term market growth in this sector.

Marine Scrubber Market Regional Analysis

Europe is a leader in green shipping projects and early regulatory implementation. The European Union's Sulphur Directive enforces stricter SOx limits throughout member states, particularly in the Baltic and North Sea ECAs. According to the European Maritime Safety Agency (EMSA), more than 60% of vessels in European seas use onboard scrubbers to meet sulfur emissions regulations. Countries like Norway and Germany are pioneering retrofitting projects, and the European Green Deal encourages investment in sustainable maritime solutions. The expansion of LNG facilities and the use of low-emission ships strengthen Europe's position as a main center for marine scrubber market innovation and application.

Asia-Pacific is expected to have the greatest growth rate throughout the marine scrubber market forecast period. According to UNCTAD's Review of Maritime Transport 2023, major shipbuilding nations such as China, South Korea, and Japan dominate global fleet production, accounting for more than 90% of newbuild deliveries. China's Ministry of Transportation has imposed stringent pollution standards around its beaches, particularly in the Yangtze River Delta, Pearl River Delta, and Bohai Rim seas. Increased trade volumes, fast construction of port infrastructure, and growing awareness of environmental compliance are driving market growth. Domestic demand for retrofits in aged fleets, as well as increased investment in hybrid and LNG ships, boost Asia-Pacific's market dynamics.

Marine Scrubber Market Leading Companies

The marine scrubber players profiled in the report is Clean Marine AS, Alfa Laval AB, Damen Shipyards Group N.V., Ecospray Technologies S.r.l., DuPont, Fuji Electric Co. Ltd., Valmet Corporation, Mitsubishi Heavy Industries, Wärtsilä Oyj Abp, and Yara Marine Technologies AS.

Marine Scrubber Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East And Africa