Operating Room Integration Market Growth Opportunities and Forecast till 2032

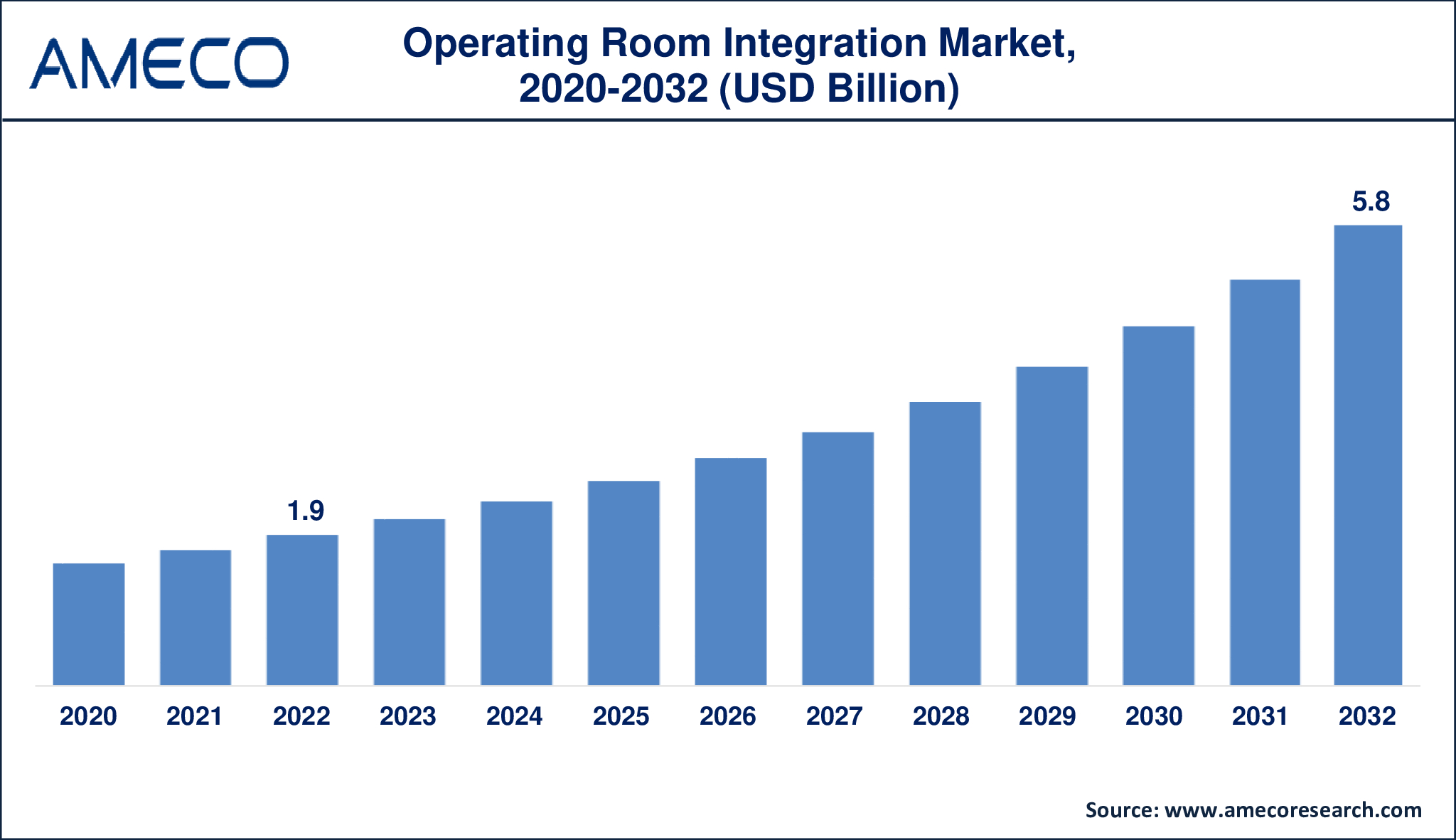

The Global Operating Room Integration Market Size was valued at USD 1.9 Billion in 2022 and is anticipated to reach USD 5.8 Billion by 2032 with a CAGR of 11.9% from 2023 to 2032.

In the operation theatre (OT), integration mainly refers to systems integration, which involves connecting the operation theatre environment functionally. It comprises audio, video, surgical lighting, room lights, building automation (HVAC), medical equipment, telemedicine, and videoconferencing, among other things. When all technology is interconnected, a single operator may control it all from a central command console. Integration in operation theatre is crucial for the successful implementation of minimally invasive surgery, robotic surgery, and Services operation theatre. An integrated operation room saves time and resources by allowing existing employees to conduct more operations in the same room without putting additional load on the team or shifting equipment or workers from another OT.

|

Parameter |

Operating Room Integration Market |

|

Operating Room Integration Market Size in 2022 |

US$ 1.9 Billion |

|

Operating Room Integration Market Forecast By 2032 |

US$ 5.8 Billion |

|

Operating Room Integration Market CAGR During 2023 – 2032 |

11.9% |

|

Operating Room Integration Market Analysis Period |

2020 - 2032 |

|

Operating Room Integration Market Base Year |

2022 |

|

Operating Room Integration Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Device Type, By Component, By Application, By End-Use, and By Region |

|

Operating Room Integration Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Barco, Stryker Corporation, Brainlab AG, Olympus, KARL STORZ SE & CO. KG, Dragerwerk AG & Co. KGaA, Getinge AB, Steris, Care Syntax, and Trilux Medical GmbH& Co.KG. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Operating Room Integration Market Dynamics

The increasing number of surgeries all over the world propels the global operating room integration market growth. Hospitals are increasingly attempting to construct state-of-the-art OTs in order to recruit and retain medical workers by providing them with cutting-edge facilities. Having integrated technology, such as knowledge or bulletin board systems, improves overall efficiency and patient safety in the OT. These systems integrate patient and staff information, as well as equipment and procedure documentation, and display it on a large screen in the room.

Changes in reimbursement regulations and a tendency toward shorter inpatient stays have made surgery the major source of revenue for hospitals during the last two decades. One reason for this is that hospitals are increasingly looking to develop cutting-edge operating rooms. By attracting and maintaining top surgeons by providing them with the most advanced instruments, a clinic can perform more treatments.

Operating room integration arose from the development and expansion of minimally invasive surgery (MIS). In the United States nowadays, minimally invasive surgery is used in more than half of the instances. Slender surgical steel tubes are placed through small incisions in the anatomy to route surgical tools, cameras, aspiration tubes, lighting, and air management systems. The surgeon has an optimum view of the surgery field thanks to a high-quality, enlarged video presented on a flat-screen monitor. Smaller incisions imply less discomfort, quicker recovery, and shorter hospital stays—or none at all. Operating room integration will likely become the industry norm within the next few years as MIS grows and robotic surgery and telemedicine become increasingly popular.

High costs involved with integrating modern technologies into existing infrastructure, as well as a shortage of experienced workers to manage these systems, are projected to stymie the worldwide operating room integration market's expansion. Furthermore, the growing medical tourism, rapid urbanization in emerging economies, improving healthcare infrastructure across the world are expected to further drive the market in coming years.

Global Operating Room Integration Market Segment Analysis

Operating Room Integration Market By Device Type

· Display System

· Audio Video Management System Forceps

· Documentation Management System

In the operating room integration industry, display systems emerged as the leading device type, accounting for the majority of the market. Display systems are vital in contemporary operating rooms because they allow surgeons, doctors, and medical personnel to see patient data, imaging scans, surgical processes, and other critical information in real time. These systems often contain high-resolution monitors, touchscreens, and display panels built into surgical equipment and consoles, allowing for effective communication, cooperation, and decision-making during surgical procedures. With the growing use of minimally invasive surgeries, image-guided treatments, and improved medical imaging technologies, the need for sophisticated display systems in operating rooms is increasing, propelling growth in this area of the operating room integration market.

Operating Room Integration Market By Component

· Software

· Services

In the operating room integration market, the services component emerged as the leading category, accounting for the greatest share of the market. Manufacturers, integrators, and third-party service providers offer a wide variety of operating room integration services, including installation, setup, maintenance, training, and support. These services are critical for assuring the smooth deployment, operation, and maintenance of integrated operating room systems, as well as enhancing system performance and increasing healthcare facility ROI. With the growing use of advanced surgical technologies, ongoing technological advancements, and the need for specialized expertise in operating room integration, demand for comprehensive services remains high, driving the growth of this segment within the operating room integration market.

Operating Room Integration Market By Application

· General Surgery

· Orthopedic Surgery

· Neurosurgery

· Others

In the operating room integration market, the application of general surgery emerged as the dominant segment, commanding the largest share of the market. General surgery encompasses a broad range of surgical procedures, including abdominal surgeries, trauma surgeries, and procedures involving the gastrointestinal tract, liver, pancreas, and other vital organs. Operating room integration solutions play a crucial role in general surgery by facilitating real-time access to patient data, imaging scans, medical records, and surgical planning tools, enhancing surgical precision, efficiency, and patient safety. With the growing prevalence of chronic diseases, aging populations, and the increasing demand for minimally invasive surgical techniques, the volume of general surgeries performed worldwide continues to rise, driving the demand for integrated operating room solutions tailored to meet the specific needs of general surgical procedures. As a result, the general surgery application dominates the operating room integration market.

Operating Room Integration Market By End-Use

· Hospitals

· Ambulatory Surgical Centers (ASCs)

In the operating room integration market, hospitals emerged as the main end-use category, accounting for the majority of the market. Hospitals are the principal settings for surgical operations, both regular and difficult, spanning a wide range of medical disciplines. Operating room integration solutions are crucial in hospitals because they enable the seamless integration of medical instruments, imaging systems, communication tools, and patient data management systems, hence improving workflow efficiency and patient care delivery. With a growing emphasis on patient safety, clinical efficiency, and cost-effectiveness in healthcare settings, hospitals continue to invest in innovative technology and integrated operating room solutions to satisfy surgical teams' changing demands and enhance surgical results. As a result, hospitals dominate the operating room integration market.

Operating Room Integration Market Regional Analysis

North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa are the segmentation of the global operating room integration industry. North America among all the regions generated the largest revenue in 2020. This is due to the presence of key players in the region, the presence of advanced healthcare facilities in the region, and the growth in technological advancements in the healthcare sector. However, the Asia-Pacific region is expected to attain the fastest growth rate during the forecast period 2021 – 2028, owing to the growing government investments for the healthcare infrastructure, an increasing number of diseases in countries such as China and India, and rising awareness for advanced surgeries.

Operating Room Integration Market Leading Companies

The operating room integration market players profiled in the report are Barco, Stryker Corporation, Brainlab AG, Olympus, KARL STORZ SE & CO. KG, Dragerwerk AG & Co. KGaA, Getinge AB, Steris, Care Syntax, and Trilux Medical GmbH& Co.KG.

Operating Room Integration Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa