Platelet Rich Plasma Market Size, Growth Trends, and Forecast to 2033

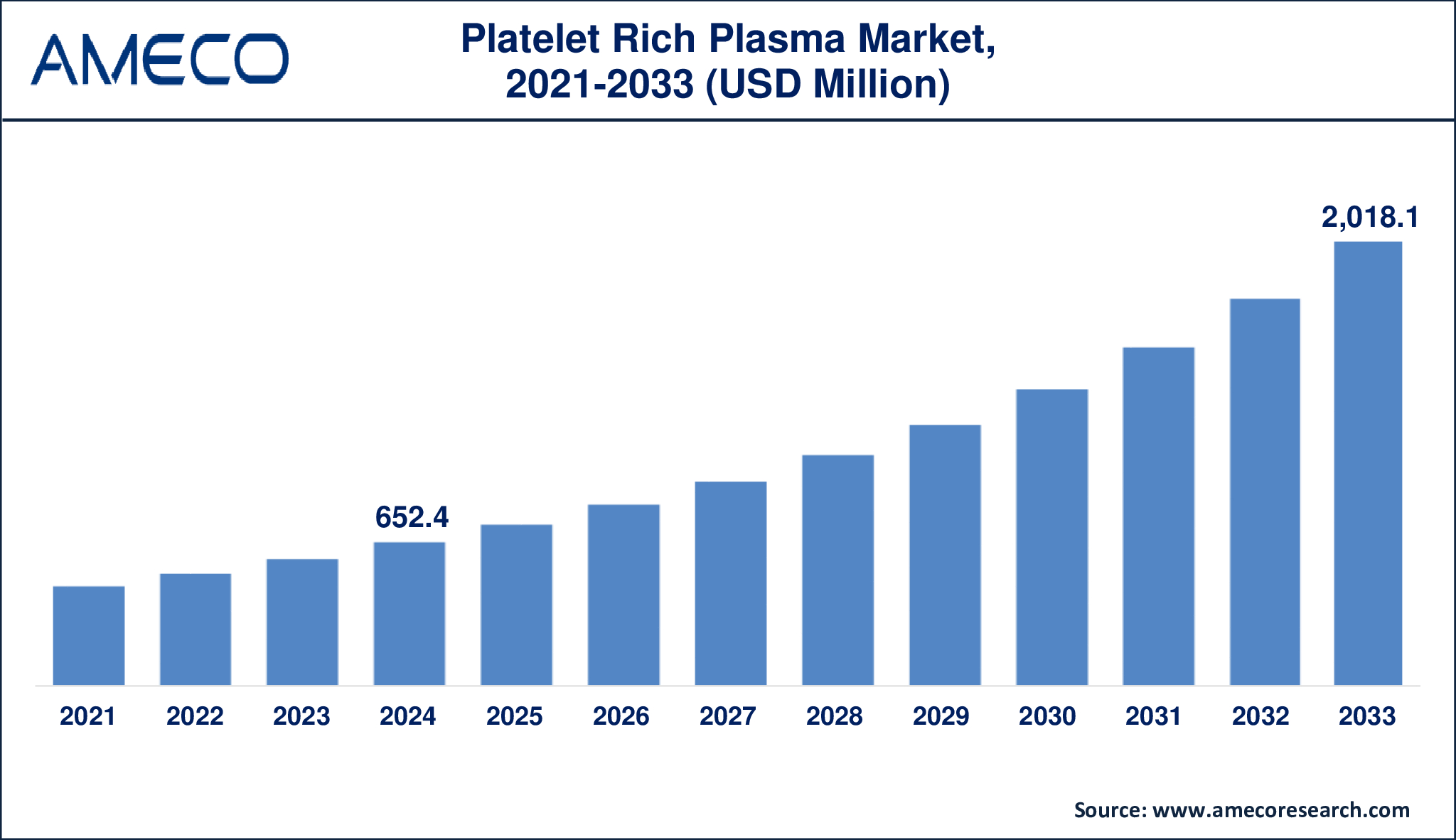

The Global Platelet Rich Plasma Market Size was valued at USD 652.4 Million in 2024 and is anticipated to reach USD 2,018.1 Million by 2033 with a CAGR of 13.5% from 2025 to 2033.

Platelet-rich plasma (PRP) is made from a person’s own blood by separating out the platelets. Usually, blood is taken out and put in a centrifuge to divide the components so that red blood cells are reduced and platelet concentration is increased many times over. The enriched plasma is injected into the areas where healing or new tissue generation is needed. Since, PRP is made from the patient’s blood, the risk of immune problems or disease transfer is very low, making it safe to use for treatment.

The main value of PRP lies in the many growth factors found in the concentrated platelets which encourage cell repair, decrease inflammation and help the body regenerate tissue. PRP therapy is now used in sports medicine for treating muscle and tendon problems, dermatology to help with skin rejuvenation and hair loss and dentistry to support healing after procedures. While the effectiveness of PRP depends on its preparation and what it’s used for, it is still a useful method in regenerative medicine. The main benefit is using your body’s own processes to support recovery and improve results without turning to surgery or drugs.

|

Parameter |

Platelet Rich Plasma Market |

|

Platelet Rich Plasma Market Size in 2024 |

US$ 652.4 Million |

|

Platelet Rich Plasma Market Forecast By 2033 |

US$ 2,018.1 Million |

|

Platelet Rich Plasma Market CAGR During 2025 – 2033 |

13.5% |

|

Platelet Rich Plasma Market Analysis Period |

2021 - 2033 |

|

Platelet Rich Plasma Market Base Year |

2024 |

|

Platelet Rich Plasma Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product, By Type, By Application, And By Region |

|

Platelet Rich Plasma Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Juventix, Zimmer Biomet, Dr. PRP America, LLC, EmCyte Corporation, Celling BioSciences, Johnson & Johnson (DePuy Synthes), T-Biotechnology (T-LAB), Glofinn Oy, Arthrex, Inc., APEX Biologix, Terumo BCT, Inc., and Stryker. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Platelet Rich Plasma Market Dynamics

The growth of the platelet rich plasma (PRP) market is being led by people seeking less invasive and customized treatments. The Centers for Disease Control and Prevention predicts that 78 million adults in the United States will suffer from arthritis by 2040. According to the Osteoarthritis Action Alliance (OAAA), in 2019, 242 million people worldwide experienced osteoarthritis symptoms that restricted their activities and of those, 43 percent were aged 65 or more. Because it reduces pain, supports healing and makes surgery less necessary, PRP therapy is now a popular choice for treating musculoskeletal problems. Improvements in how PRP is made have made the treatment more successful and attractive to both orthopedic and sports medicine specialists.

In addition, the PRP market growth is being driven by the increasing use of PRP in cosmetics. As more people have extra money to spend and want non-surgical procedures, PRP has become more popular in facial rejuvenation, restoring hair and treating scars. A report from the American Society of Plastic Surgeons in December 2020 pointed out that PRP greatly improves cosmetic procedures by using the body’s natural ability to restore tissue. According to the International Osteoporosis Foundation, in 2021, osteoporosis-related fractures happened to more than 8.9 million people and about 20% of men and 33% of women over the age of 50 experienced them. Due to its ability to regenerate, PRP is an appealing choice for additional therapy in these cases. Moreover, an increase in clinical trials investigating PRP for COVID-19 treatments shows that many are interested in exploring additional uses for PRP.

Regardless of its increased use, the PRP market is limited by difficulties in pricing and inconsistent policies for reimbursement. Since PRP therapy is costly and not often covered by insurance, many people cannot use it. Additionally, there is no standard way to prepare patients and the rules for cancer treatment change from country to country, causing uneven results. Such problems make it hard for PRP therapies to be widely used in markets where money is a major concern.

Furthermore, using PRP in plastic and reconstructive surgery is opening up new opportunities for the industry. More and more, PRP is helping patients heal faster after surgery and get better results from cosmetic procedures. The American Society of Plastic Surgeons has agreed that regenerative medicine improves the results of surgical procedures. As people become more aware of beauty and aesthetic treatment, the need for PRP-based cosmetic treatments is expected to increase a lot.

Orthopedics is finding that PRP can support the growth of bones and help treat long-lasting inflammatory conditions such as tendonitis and osteoarthritis. According to a 2020 report in The Lancet, about 654 million individuals aged 40 and older around the world had knee osteoarthritis. Because chronic conditions are becoming more common worldwide, innovative treatments like PRP are needed. More research and the creation of standard guidelines are expected to bring radiology to many new medical areas and markets.

Global Platelet Rich Plasma Market Segment Analysis

Platelet Rich Plasma Market By Product

· Pure Platelet-Rich Plasma

· Leukocyte Platelet-Rich Plasma

· Pure Platelet-Rich Fibrin

· Leukocyte Platelet-Rich Fibrin

As per the Platelet Rich Plasma industry analysis, the pure platelet-rich plasma (P-PRP) segment was the largest in 2024, holding almost 50% of the market share. P-PRP, sometimes called L-PRP, is identified by having very few leukocytes and forming a delicate fibrin network after activation. This kind of plasma is made by spinning and contains lots of platelets and growth factors which makes it suitable for both injections and gel treatments. Because P-PRP heals faster and more effectively, it is the top option in regenerative medicine. Thanks to its success in helping patients with chronic diseases and aiding tissue healing, the interest from researchers and healthcare workers is pushing the market forward.

Platelet Rich Plasma Market By Type

· Autologous Platelet-Rich Plasma

· Allogeneic Platelet-Rich Plasma

· Homologous Platelet-Rich Plasma

Autologous, allogenic and homologous PRP are the main types in the platelet-rich plasma market. In 2024, the autologous part of the market was responsible for about 80% and was thus the largest segment. PRP taken from the patient’s own blood greatly reduces the chance of the patient’s body rejecting the treatment or contracting a disease. Because it is safe and effective, it is often used in many areas of medicine. Because of its effectiveness and safety, the use of autologous PRP keeps increasing for different conditions such as musculoskeletal injuries, unhealed wounds and cosmetic treatments.

Platelet Rich Plasma Market By Application

· Cosmetic Surgery

· Orthopedic Surgery

· Ophthalmic Surgery

· Dentistry

· Cardiac Surgery

· Neurosurgery

· Others

The orthopedic surgery sector was the largest part of the PRP market in 2024, accounting for 30% of the total. The trend toward using PRP is what drives this kind of leadership in orthopedics. More and more, doctors in this field are using PRP to heal tissues faster, control pain and boost recovery in osteoarthritis, tendinopathies and soft tissue injuries. Because people are looking for less invasive ways to treat injuries, PRP is now used more often in orthopedic care. With musculoskeletal disorders on the rise all over the world, this segment is expected to remain on top for years to come.

Platelet Rich Plasma Market Regional Analysis

In 2024, North America accounted for 43% of the platelet-rich plasma market thanks to both population changes and advancements in healthcare. Because there are more elderly people and many accidents leading to injuries, more people are asking for PRP and other regenerative methods. The rise in both orthopedic and cosmetic surgeries, as well as a regular influx of new products, has helped the industry. The development of new treatments, effective healthcare systems and supportive rules are all helping the region to grow. The region is also leading in PRP use due to high incomes and people’s willingness to try new treatments. The CDC reported in 2019 that more than 32.5 million people in the United States were affected by osteoarthritis, showing that PRP could play a key role in helping with such chronic joint conditions.

The strong clinical research environment in Germany was the main reason for its leading share of the European PRP market in 2024. A survey carried out in 2020 by the "Working Group for Clinical Tissue Generation" pointed out that using consistent methods for PRP treatment is necessary for treating knee osteoarthritis. The presence of many regional PRP producers and suppliers is predicted to support continued growth in Europe.

The PRP market in Asia-Pacific is expected to grow the most from 2025 to 2033 because of the increasing number of orthopedic disorders and sports injuries. More people are using PRP because its advantages are now better known to both medical professionals and patients. With healthcare and sports medicine upgrades happening in the region, demand for platelet-rich plasma therapies should rise considerably.

Platelet Rich Plasma Market Leading Companies

The Platelet Rich Plasma players profiled in the report is Juventix, Zimmer Biomet, Dr. PRP America, LLC, EmCyte Corporation, Celling BioSciences, Johnson & Johnson (DePuy Synthes), T-Biotechnology (T-LAB), Glofinn Oy, Arthrex, Inc., APEX Biologix, Terumo BCT, Inc., and Stryker.

Platelet Rich Plasma Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East And Africa