Server Market Growth Opportunities and Forecast till 2032

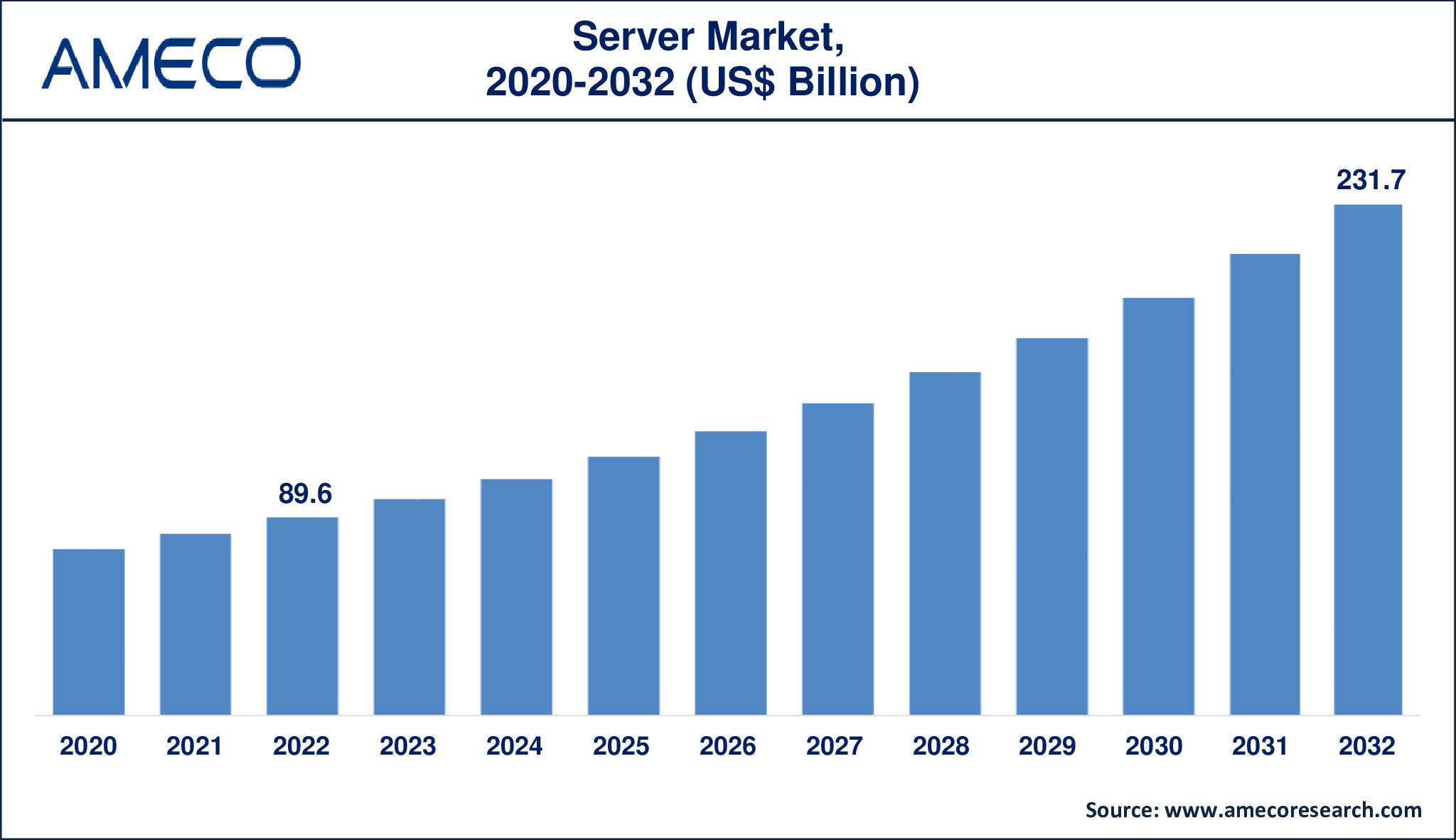

The Server Market Size was valued at USD 89.6 Billion in 2022 and is anticipated to reach USD 231.7 Billion by 2032 with a CAGR of 10.1% from 2023 to 2032.

Servers, which are powerful computer equipment, intended to process, store, and manage network data, devices, and systems, play an important role in driving organizational activities. Servers help to improve scalability, efficiency, and business continuity by providing enough of resources to network components and systems. In compared to two decades ago, personal computing devices such as laptops and workstations today provide more advanced features for BFSI. However, current physical, virtual, and cloud servers provide fault tolerance, intelligent load balancing, and scalability, allowing for effective network administration. Unlike home computers, servers are usually running 24 hours a day, seven days a week to provide critical services. As a result, server breakdowns provide substantial issues for both the firm and network BFSI. To address these challenges, servers are frequently configured with fault-tolerant techniques.

|

Parameter |

Server Market |

|

Server Market Size in 2022 |

US$ 89.6 Billion |

|

Server Market Forecast By 2032 |

US$ 231.7 Billion |

|

Server Market CAGR During 2023 – 2032 |

10.1% |

|

Server Market Analysis Period |

2020 - 2032 |

|

Server Market Base Year |

2022 |

|

Server Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Product, By Enterprise Size, By Industry Vertical, and By Region |

|

Server Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Dell, Fujitsu, Hewlett Packard Enterprise, Huawei Technologies Co. Ltd., IBM, Inspur Technologies Co. Ltd., Lenovo, ASUSTeK Computer Inc., Cisco Systems, Inc., and Intel Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Server Market Dynamics

The global server industry is expanding rapidly, driven mostly by the expansion of new data centers throughout the world. The exponential increase of data is a major driver moving the market forward. The growing worldwide demand for social, mobile, analytics, and cloud services is driving Energy to seek out external vendors specialized in data center administration. Colocation data centers, in particular, are becoming popular because they provide physical space, electricity, cooling systems, and access to local communication networks.

The increasing volume of data created by social media platforms and applications has had a significant impact on the server business. In 2021, the worldwide number of social media users reached 4.48 billion, a phenomenal 13.13 percent rise from 3.69 billion in 2020. This growth in social media activity considerably increases the demand for server infrastructure.

Furthermore, the fast growth of cloud service providers is expected to increase business demand. Notably, a considerable percentage of email sender and recipient data is now saved on the servers of the firms that provide email services, rather than on individual PCs. For example, Gmail data is saved on Google servers, but Hotmail data is stored on Microsoft servers.

As the server market evolves, rising technologies, cybersecurity issues, and the continued growth of edge computing will all impact the industrial landscape. The incorporation of artificial intelligence (AI) and machine learning (ML) into server operations, together with the requirement for improved security measures, will most certainly play a critical role in determining the future trajectory of the worldwide server industry.

Global Server Market Segment Analysis

Server Market By Product

· Blade

· Micro

· Open Compute Project (OCP)

· Rack

· Tower

According to the server industry analysis, rack servers continue to dominate the worldwide server market. Rack servers are a popular choice for data centers and companies due to their versatility and space efficiency. Their modular architecture enables simple expansion, making them appropriate for a broad range of applications, from small Energy to large-scale data processing systems. Rack servers are in high demand because of their ability to handle a wide range of workloads effectively, provide outstanding energy economy, and allow for simpler management. While other server products such as blade, micro, Open Compute Project (OCP), and tower servers cater to specific use cases, rack servers maintain a significant market share due to their adaptability, performance, and widespread adoption across industries, ensuring their continued dominance in the server market.

Server Market By Enterprise Size

· Large

· Medium

· Micro

· Small

Large organizations dominate the present server market landscape. Large organizations have a significant need for server infrastructure due to their vast computing needs, complicated IT infrastructures, and massive data processing requirements. Large businesses frequently install a wide range of applications and services, demanding powerful and scalable server solutions to support their operations. Furthermore, the introduction of technologies such as cloud computing, big data analytics, and virtualization increases the need on powerful server infrastructure, which corresponds to the resource-intensive nature of large-scale commercial activities. While servers catering to medium, small, and micro organizations handle certain specialized requirements, the sheer scope and complexity of IT infrastructures in big Energy contribute to their dominant position in driving demand and innovation within the server industry.

Server Market By Industry Vertical

· BFSI

· Energy

· Government & Defense

· Healthcare

· IT & Telecom

· Others

According to the server market forecast, the information technology and telecommunications (IT & Telecom) sector is predicted to take the lead in the server market. The IT and telecom industries have an unwavering demand for strong server infrastructure to enable data storage, processing, and the smooth functioning of communication networks. The growing acceptance of cloud services, digital transformation projects, and the expansion of mobile technologies in the IT and telecommunications sectors all contribute to the increased demand for servers. Furthermore, the increasing complexity of IT infrastructures, along with the demand for scalable and dependable solutions, propels this business vertical to the forefront of server market supremacy. While other industries, such as BFSI, Energy, Government & Defense, Healthcare, and others, have unique server requirements, the IT & Telecom industry's dynamic nature and quick technical breakthroughs continue to play an important role in creating the server market landscape.

Server Market Regional Analysis

The worldwide server market is divided into five geographic regions: North America, Europe, Latin America, Asia-Pacific, and the Middle East and Africa. North America now has the world's largest hosting market, with a substantial number of dedicated servers spread across the continent. This is due to the presence of multiple data centers and cloud service providers in the region. In contrast, Asia-Pacific is expected to develop at the quickest rate in coming years. Increased usage of social media platforms, mobile wallets, and digital services in emerging nations is expected to contribute to this increase. These countries are anticipated to increase their investment in IT infrastructure, with data centers developing globally as part of numerous smart city development programs. The increasing need for data storage underpins the growth trajectory in the Asia-Pacific region.

Server Market Leading Companies

The Server Market players profiled in the report are Dell, Fujitsu, Hewlett Packard Enterprise, Huawei Technologies Co. Ltd., IBM, Inspur Technologies Co. Ltd., Lenovo, ASUSTeK Computer Inc., Cisco Systems, Inc., and Intel Corporation.

Server Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa