Substation Market Growth Opportunities and Forecast till 2032

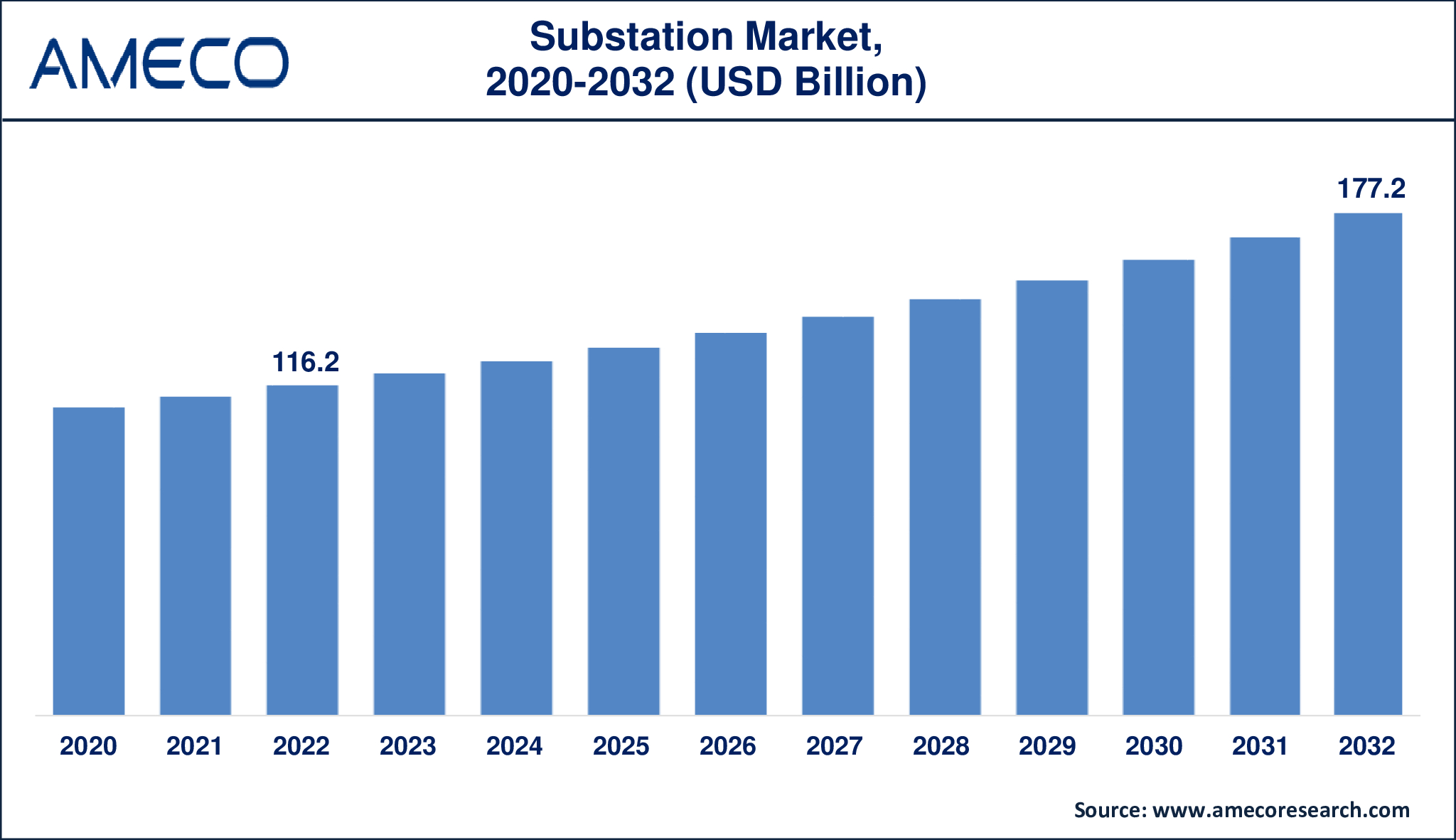

The Global Substation Market Size was valued at USD 116.2 Billion in 2022 and is anticipated to reach USD 177.2 Billion by 2032 with a CAGR of 4.4% from 2023 to 2032.

Substations are components of the electrical generation, transmission, and distribution network. They change the voltage from high to low (or vice versa) and conduct a variety of other important tasks. Substations can be built in a variety of places, depending on the resources available. Substations with equipment, transformers, circuit breakers, and switches come in a variety of shapes and sizes. Power generating substations can currently meet the rapidly rising demand for electricity in every city and town. Nuclear, thermal, and hydroelectric stations are among the many types of power generation substations around the world.

|

Parameter |

Substation Market |

|

Substation Market Size in 2022 |

US$ 116.2 Billion |

|

Substation Market Forecast By 2032 |

US$ 177.2 Billion |

|

Substation Market CAGR During 2023 – 2032 |

4.4% |

|

Substation Market Analysis Period |

2020 - 2032 |

|

Substation Market Base Year |

2022 |

|

Substation Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Technology, By Component, By Connectivity, By Application, By Voltage Level, and By Region |

|

Substation Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Alphapower Electrical Technology PLC, Belden, Cisco Systems, Eaton, Efacec, Emerson Electric, General Electric, NetControl Group, NR Electric, Rockwell Automation, Schneider Electric, Siemens, Tesco Automation, and Texas Instruments. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Substation Market Dynamics

The increased need for efficient electricity worldwide is the primary factor driving the growth of the global substation market. Substations are deployed to convert high-voltage electricity from the transmission system to lower-voltage electricity that can be conveniently distributed to homes and businesses via distribution lines. In addition, power generation capacity additions for distribution networks, as well as the upgrading of existing power infrastructures, are two major drivers that are expected to enhance the substation industry.

One of the most significant difficulties that utilities confront today is the aging of their power generation and distribution facilities. Utilities and grid operators bear enormous costs as a result of electricity infrastructure failure. According to the US Department of Energy, almost 75% of transmission lines and transformers in the United States are over 25 years old.

In addition, the sector is being propelled forward by expanding infrastructure development in smart cities, the rising need to replace old substation equipment, and increased interoperability and safety. However, high initial set-up costs associated with substations, as well as increased concerns about cyber-attacks, are projected to constrain demand for the substation industry. On the other hand, increasing investments of power companies in transmission and distribution networks are likely to generate numerous growth opportunities for the market in the coming years. Furthermore, the market expansion is projected to be aided by a greater focus on renewable energy generation and distribution in the coming future.

Global Substation Market Segment Analysis

Substation Market By Technology

· Conventional

· Digital

In the field of technology, the market is typically split into two primary segments: traditional and digital. Notably, in 2022, the digital segment emerged as the dominating force, accounting for the bulk of the market. This trend indicates growing demand for digital technology in a variety of businesses and applications. Several causes are driving the spike in demand.

For starters, the growing need for power, fueled by industrialization, urbanization, and population increase, is propelling the use of digital technology. As global energy consumption rises, digital technologies provide more effective and sustainable methods to create, distribute, and control electricity.

Second, the fast growth of smart cities is driving up the need for digital technologies. Smart city efforts rely significantly on digital infrastructure to optimize resource allocation, improve public services, and raise overall urban living standards. Digital technologies enable the integration of several systems, including transportation, energy, and communication, resulting in more connected and efficient urban settings.

Substation Market By Component

· Electrical System

o Transformer

o Busbar

o Protection Devices

§ Circuit Breaker

§ Protective Relay

§ Switchgear

· Substation Automation System

· Communication Network

· Monitoring & Control System

o Human Machine Interface

o Programmable Logic Controller

o Others

· Others

Electrical system (transformer, busbar, and protection devices (circuit breaker, protective relay, and switchgear)), substation automation system, communication network, monitoring & control system (human machine interface, programmable logic controller, and others), and others are covered under the component segment. Based on the component segment, the substation automation system held the maximum share in 2022. The introduction of cloud computing and the deployment of IoT are two important trends that will allow substation automation to be integrated for operational and financial benefits.

Substation Market By Connectivity

· > 110 kV to ≤ 220 kV

· ≤ 33 kV

· > 220 kV to ≤ 550 kV

· > 33 kV to ≤ 110 kV

· >550 kV

The connectivity segment is divided into ≤ 33 kV, > 110 kV to ≤ 220 kV, > 220 kV to ≤ 550 kV, > 33 kV to ≤ 110 kV, and >550 kV. In 2022, ≤ 33 kV connectivity segment occupied the biggest share and is expected to lead the market in coming years. Growing planned investments and installation of ≤ 33 kV connectivity infrastructure in the Asia-Pacific region is likely to drive the segmental growth. For instance, the Asia Pacific substation market would have installed approximately 13,000 units per year by 2027.

Substation Market By Application

· Transmission

· Distribution

Transmission and distribution are different parts of the energy economy, separated by their respective purposes. Notably, in 2022, the transmission segment emerged as a major force, accounting for a sizable part of the market. This significance can be traced to transmission lines' vital function in transferring enormous amounts of energy across great distances, frequently from power plants to substations and key industrial areas. The transmission segment's strong market position is due to the rising need for dependable and efficient transmission infrastructure, which is being driven by factors such as urbanization, industrial growth, and the increase of renewable energy sources.

Substation Market By Voltage Level

· Low

· Medium

· High

The market for energy systems is frequently split by voltage level, with low, medium, and high voltage categories. Notably, in 2020, the high voltage category had a major jump in demand, driven by the increased need for high voltage energy in both established and emerging nations. This trend indicates an increasing emphasis on strong and efficient energy transmission and distribution infrastructure to fulfill the expanding power demands of industries, commercial organizations, and residential regions.

Substation Market By End-Use

· Utility

· Industrial

The energy industry's end-use segment is divided into two major categories: utility and industrial. In 2020, the utilities category emerged as the dominating player, accounting for the highest market share. This dominance is largely motivated by the critical role that utilities play in delivering power to residential, business, and institutional customers. Utilities are responsible for generating, transferring, and distributing energy across enormous infrastructure networks, guaranteeing a consistent and uninterrupted power supply to suit the different demands of users.

Substation Market Regional Analysis

North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa are the categorization of the global Substation market. North America maintained a significant market share among regional distribution in 2022, because of the growing construction of smart grid networks and the restoration and refit of existing grid infrastructure. The Asia-Pacific region is predicted to have the highest CAGR during the forecast period due to growing industrialization, upgrading of grid infrastructure, and the entry of many private enterprises into the power sector. Increased government spending to enhance the utility industry, as well as an increase in the number of power utilities, are some of the main factors contributing to the Asia-Pacific substation market's quickest growth rate.

Substation Market Leading Companies

The Substation market players profiled in the report are Alphapower Electrical Technology PLC, Belden, Cisco Systems, Eaton, Efacec, Emerson Electric, General Electric, NetControl Group, NR Electric, Rockwell Automation, Schneider Electric, Siemens, Tesco Automation, and Texas Instruments.

Substation Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa