Electric Excavator Market Growth Opportunities and Forecast till 2032

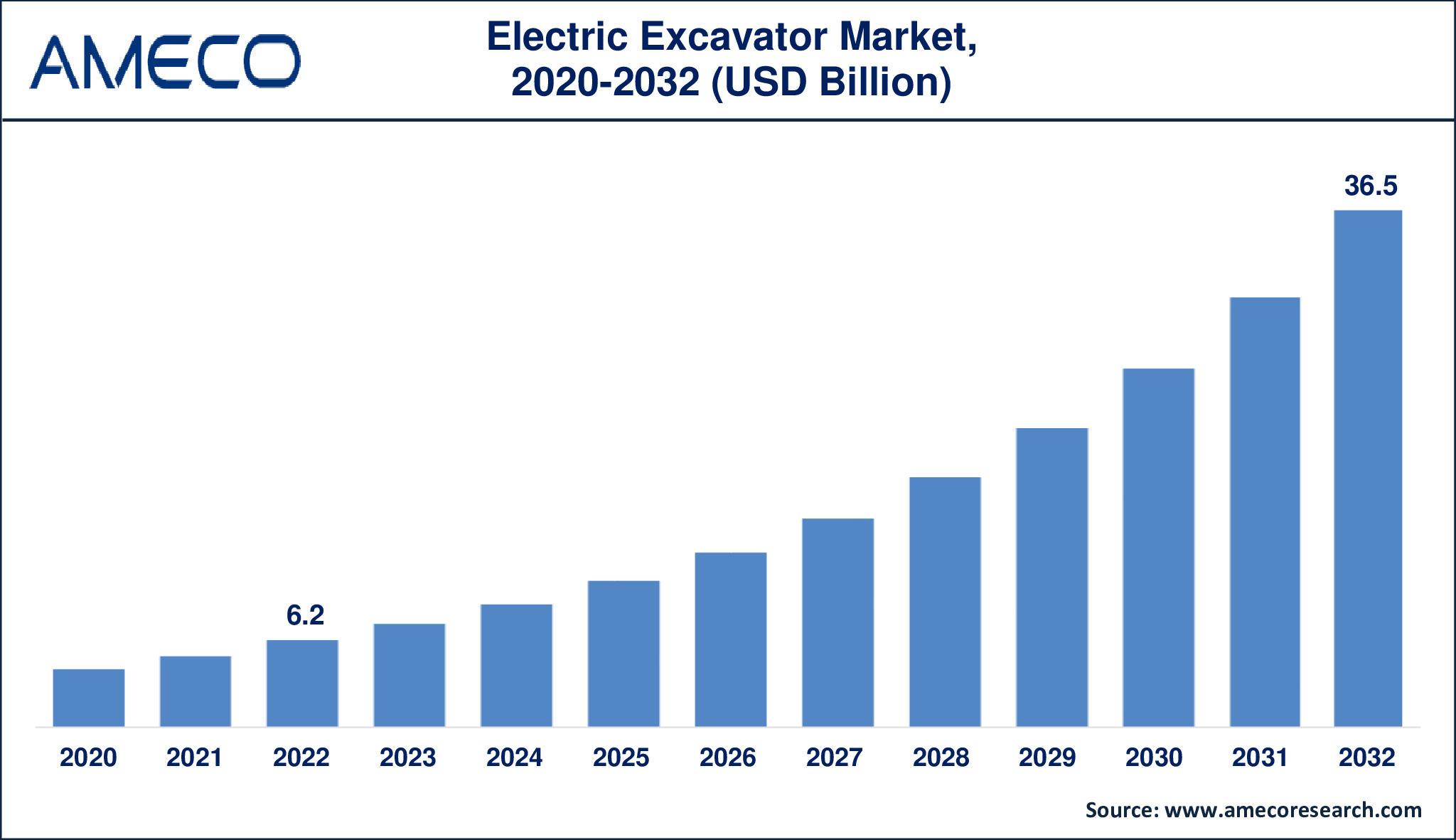

The Global Electric Excavator Market Size was valued at USD 6.2 Billion in 2022 and is anticipated to reach USD 36.5 Billion by 2032 with a CAGR of 19.5% from 2023 to 2032.

Excavators are massive construction machines featuring a boom, arm, bucket, and cab mounted on a rotating superstructure above a track or wheeled undercarriage. These machines are primarily used for digging and various lifting and hauling operations in a variety of Powers. These machines are typically tracked, but some variants feature wheels. Instead of hydraulics, an electric excavator's boom is powered by electromechanical linear actuators. While producing electric equipment would be a significant change for businesses, there are numerous advantages to doing so. Electric equipment, in particular, is beneficial to the environment. Construction accounts for 11% of all energy-related carbon emissions. However, electric equipment offers far more than environmental advantages.

|

Parameter |

Electric Excavator Market |

|

Electric Excavator Market Size in 2022 |

US$ 6.2 Billion |

|

Electric Excavator Market Forecast By 2032 |

US$ 36.5 Billion |

|

Electric Excavator Market CAGR During 2023 – 2032 |

19.5% |

|

Electric Excavator Market Analysis Period |

2020 - 2032 |

|

Electric Excavator Market Base Year |

2022 |

|

Electric Excavator Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Product Type, By Propulsion, By Power, By End-Use Industry, and By Region |

|

Electric Excavator Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Bobcat (Doosan), Caterpillar, Hitachi, Hyundai Construction Equipment, Komatsu, Kubota, LiuGong, Mecalac, SENNEBOGEN, Volvo Construction Equipment, and Wacker Neuson. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Electric Excavator Market Dynamics

Growth in construction activities across the world is the primary factor boosting the electric excavator market. Over the last few decades, trends in the global construction business have changed at a breakneck speed. The worldwide urban population is rising at a rate of about 200,000 people every day, according to a World Economic Forum analysis. Furthermore, according to the journal, the world urban population is predicted to surpass 6 billion by 2045, putting enormous pressure on the construction business. A large increase in the number of industrial, residential, and commercial projects is predicted to support this flow of people into urban regions around the world. Furthermore, the large growth in the number of general construction projects will have an impact on the construction of civil projects such as trains, airports, highways, bridges, and other infrastructure.

In addition, increasing awareness for construction equipment for its performance and efficiency is another factor driving the global electric excavator market trend. Construction equipment saves time and money by reducing labor costs and allowing workers to work more efficiently throughout the day. Construction equipment works efficiently, which aids in project completion. With the avoidance of delay fines, this equipment boosts production and gives increased profitability. Construction equipment has evolved to accomplish various tasks to save time as a result of advancements and innovation in the sector. They can also accomplish activities that are too difficult or delicate for human muscles. Where there is a dearth of skilled or non-skilled laborers, construction equipment can sustain a projected rate of production.

Low-emission driving and operating is currently one of the construction machinery industry's primary development priorities, with a global concentration on battery-electric drives. Construction machinery electrification is rapidly progressing. In the year 2020, the sector witnessed a slew of new items on the market. Volvo Construction Equipment (Volvo CE), for example, has started taking orders for the ECR25 Electric compact excavator and L25 Electric wheel loader since February 2020. End customers have already received the first of the devices provided in 13 countries

Global Electric Excavator Market Segment Analysis

Electric Excavator Market By Product Type

· Wheeled

· Mini/Compact

· Crawler

· Others

In the electric excavator market, crawlers emerged as the dominating sector, accounting for the majority of the market. Crawler electric excavators have multiple benefits, including greater stability, flexibility over a variety of terrains, and digging strength, making them ideal for heavy-duty construction, mining, and infrastructure projects. Furthermore, the construction industry's increased emphasis on sustainability and emission reduction has boosted the adoption of electric-powered equipment, driving up demand for crawler electric excavators due to their efficient and environmentally friendly operation.

Electric Excavator Market By Propulsion

· Pure Electric

· Hybrid

In the electric excavator market, pure electric propulsion emerged as the dominating sector, accounting for the majority of the market. Pure electric excavators are powered entirely by electricity, which has various benefits such as zero emissions, lower operating costs, and quieter operation than typical diesel-powered excavators. Construction organizations and contractors are increasingly preferring pure electric excavators as environmental sustainability and stronger laws aimed at lowering carbon emissions become more important. Furthermore, advances in battery technology have enhanced the performance and range of electric excavators, encouraging their widespread acceptance in construction, mining, and infrastructure projects.

Electric Excavator Market By Power

· Under 10 Hp (Power Around 2 Ton)

· 10 - 20 Hp (Power around 3.5 to 4 Ton)

· Over 20 Hp

In the electric excavator market, the power category with more than 20 horsepower emerged as the dominating sector, accounting for the majority of the market. Excavators with power ratings more than 20 horsepower provide superior performance capabilities, such as enhanced digging power, quicker operation, and greater adaptability for a variety of construction and excavation operations. These bigger electric excavators are ideal for heavy-duty applications in sectors like construction, mining, and infrastructure development, where efficiency, productivity, and performance are critical. Furthermore, advances in electric motor technology and battery systems have allowed manufacturers to produce electric excavators with higher power outputs while maintaining environmental sustainability and operational efficiency, driving market demand for larger electric excavators.

Electric Excavator Market By End-Use Industry

· Construction

· Mining

· Forestry

· Others

In the electric excavator market, the construction sector emerged as the main end-use industry, accounting for the majority of the market. Electric excavators are widely used in construction tasks such as site preparation, foundation excavation, trenching, and material handling due to their versatility, efficiency, and environmental advantages. The construction industry's growing emphasis on sustainability, along with tight rules aimed at decreasing emissions and noise pollution, has accelerated the adoption of electric-powered equipment, such as excavators. Furthermore, developments in electric excavator technology, such as longer battery life, faster charging, and higher performance, have expedited their use in building projects throughout the world. Furthermore, the versatility of electric excavators allows them to be used in a wide range of construction applications, from urban development and infrastructure projects to residential and commercial construction, cementing their dominance in the construction end-use segment of the electric excavator market.

Electric Excavator Market Regional Analysis

North America, Asia-Pacific, Latin America, Europe, and the Middle East & Africa are the segmentation of the global electric excavator industry. By regions, North America is observed to gather a significant amount of share in the coming years due to the presence of major companies, growing investments by public and commercial organizations in the infrastructure sector, and the launch of new products in the region. For instance, during CONEXPO-CON/AGG 2020, the largest tri-annual construction trade exhibition in North America, in March in Las Vegas, US, XCMG's Excavator Machinery Business Department displayed eight items, including an electric hydraulic excavator built for the North American market. However, the Asia-Pacific region is expected to witness the fastest growth rate during the forecast period 2023 – 2032.

Electric Excavator Market Leading Companies

The Electric Excavator market players profiled in the report are Bobcat (Doosan), Hitachi, Caterpillar, Hyundai Construction Equipment, Komatsu, LiuGong, Kubota, Mecalac, Volvo Construction Equipment, SENNEBOGEN, and Wacker Neuson.

Electric Excavator Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa